Comparing Top Council Accounting Software: Rialtas, EdgeIT, Easy PC Accounts and Scribe

At Aubergine, where we specialise in building compliant websites for parish & town councils councils, and in my role as a councillor at Eaton Bray Parish Council in my private life, I’ve gained a dual perspective on the challenges and needs of local councils. This unique combination of experiences has provided me with a deep understanding of the administrative tasks that councils manage, particularly in financial accounting. Responding to frequent requests for software recommendations, I’ve compiled this guide to aid councils in selecting the most suitable financial accounting software.

In the dynamic and diverse world of parish and town councils, efficient management of financial affairs is crucial. As someone who navigates these challenges both from a service provider and a council member’s perspective, I recognize the importance of integrating the right tools for smooth, transparent, and compliant operations. A vital component of this toolkit is the financial accounting software you choose.

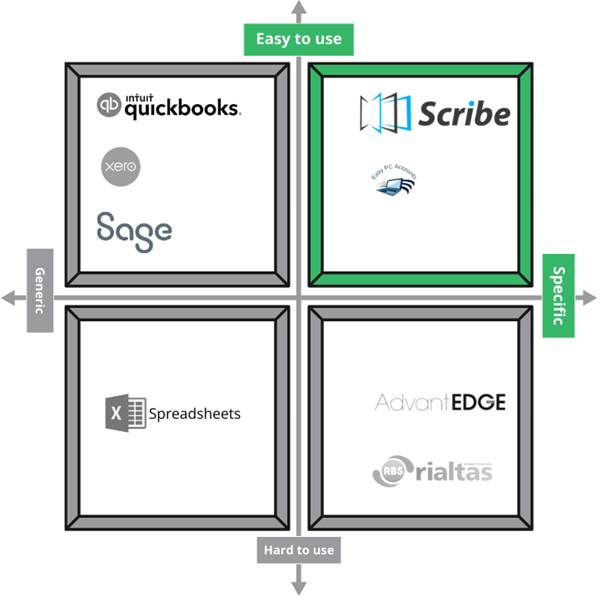

This guide aims to outline the essential criteria for selecting the right software, focusing on both the ideal features and potential red flags. The criteria have been carefully chosen based on the common and specific needs of councils, such as ease of use and council-specific functionality.

I will guide you through these criteria and evaluate various software options, including Scribe Accounts, Rialtas Omega and Alpha, AdvantEDGE Finance, Easy PC Accounts, and commercial software like Sage, Xero, and QuickBooks, keeping in mind the unique requirements of parish and town councils.

Ease of Use Versus Hard to Use

Ease of Use: Councils need software that is intuitive and simplifies complex tasks, accommodating users with varying tech skills. This ensures efficient task management and a smoother workflow.

- Red Flags: Be cautious of software that requires extensive training for basic functions, has a cluttered interface, or is not intuitive, as it could lead to operational inefficiencies.

Training and Support: A user-centric software provides comprehensive, often free, training and robust support, accommodating various learning styles.

- Red Flags: Extra costs for training and limited support indicate a lack of commitment to the user’s success.

Cloud-Based Accessibility: Crucial for modern council operations, cloud-based software facilitates efficient remote access and operational flexibility.

- Red Flags: A lack of cloud functionality, incompatibility with web browsers, or absence of role-based access can limit operational agility and data security.

Council-Specific Versus Generic Functionality

Council-Specific Features: Software should cater to specific council needs, such as reserves management, AGAR (Section 2) compliance, asset register maintenance, S.137, VAT 126, the Power to Spend, Making Tax Digital adherence, Explanation of Variances, payments awaiting authorisation, quarterly budgeting, and council-specific reporting. Additionally, adherence to GDPR and the Data Protection Act is crucial.

- Red Flags: Software lacking these specialised features or offering only basic financial functionalities can lead to compliance issues and operational inefficiencies.

Compliance and Regulation Alignment: The software must align with statutory requirements like Making Tax Digital and be updated to comply with evolving regulations.

- Red Flags: Failure to regularly update for new regulatory requirements can risk non-compliance and legal challenges.

Integration and Reporting Capabilities: The ability to generate customizable reports and integrate with other council systems is key to effective financial management.

- Red Flags: Limited reporting capabilities and poor integration can severely limit the software’s effectiveness.

By focusing on these criteria, councils can ensure they choose software that not only streamlines their financial management but also fully aligns with their specific operational needs and regulatory requirements.

Evaluating the Key Financial Accounting Software Providers for Parish and Town Councils

In our quest to find the most suitable financial accounting software for parish and town councils, it’s essential to scrutinise the offerings of various providers in the market. Let’s take a closer look at each, assessing how they stack up against our key criteria of usability and council-specific functionality.

1. Scribe Accounts (www.scribeaccounts.com)

- Usability: User-friendly, cloud-based, with free, accessible training, enhancing user experience and efficiency.

- Council-Specific Functionality: Offers features tailored to council needs, like compliance with regulations, efficient asset management, and AGAR preparation.

- Overall Assessment: A strong candidate for councils, balancing ease of use with comprehensive, council-specific functionality. May not be suitable for very large town councils that require monthly profit and loss figures.

- Star Rating: ⭐⭐⭐⭐⭐ (5 out of 5)

2. Easy PC Accounts (www.easypcaccounts.co.uk)

- Usability: Renowned for its simplicity, Easy PC Accounts offers a straightforward Cash Book system, making it extremely user-friendly and accessible, especially for users with basic accounting needs.

- Council-Specific Functionality: While being very cost-effective and suitable for small councils, it lacks support for Making Tax Digital (MTD) and does not provide Income and Expenditure reporting, which are significant considerations for councils.

- Overall Assessment: Easy PC Accounts is an excellent choice for very small councils (under £10k precept) looking for a basic, cost-effective cloud-based solution. However, its limitations in key areas like MTD compliance and comprehensive financial reporting might restrict its applicability for councils with more complex requirements.

- Star Rating: ⭐⭐⭐⭐☆ (4 out of 5)

3. Spreadsheets (e.g., Microsoft Excel)

- Usability: Familiar but can become complex for intricate tasks. Report generation and bank reconciliation are laborious. Version control and data sharing are challenging, raising issues with efficiency. Read this blog Reassessing Your Financial Management Tools: Key Questions to Consider by Tim Light, Chairman and Convenor of the Internal Auditors Forum for more details.

- Council-Specific Functionality: Lacks specialised council features. Vulnerable to data loss and security threats, posing compliance challenges with data protection regulations.

- Overall Assessment: Spreadsheets, while flexible, are prone to errors and inefficiencies, especially in terms of compliance and ease of use, making them a less reliable option for councils.

- Star Rating: ⭐⭐☆☆☆ (2 out of 5)

4. Generic Solutions (Sage, Xero, QuickBooks)

- Usability: Typically user-friendly with a more intuitive interface, appealing to a broader user base.

- Council-Specific Functionality: Lacks specialised features for council-specific needs such as AGAR and asset registers.

- Overall Assessment: While easy to use, these generic solutions may not adequately address the unique requirements of council financial management.

- Star Rating: ⭐⭐☆ ☆ ☆ (2 out of 5)

5. Rialtas (www.rialtas.co.uk)

- Usability: Designed for larger councils, Omega offers a robust, full double-entry accounting system. It’s known for its complexity and steep learning curve and may pose usability. Its desktop software is infrequently updated, resulting in outdated, clunky, and complicated processes. Known to be unforgiving, with an inability to edit transactions and correct mistakes.

- Council-Specific Functionality: Purpose-built for councils and supports Making Tax Digital. Lacks a robust asset register and Explanation of Variances Report. It does not support features like attaching files to records, drilling down into financial figures, and “power used to spend” or “payments awaiting authorisation” for transactions. Poor integration with its other packages like cemetery, allotments, and venue management.

- Overall Assessment: While robust for larger councils, the software’s complexity, infrequent updates, and hidden charges, including fees for training and year-end assistance, make it less appealing. Exporting data and report generation are also subpar.

- Star Rating: ⭐⭐⭐☆☆ (3 out of 5)

6. AdvantEDGE (www.edgeitsystems.com)

- Usability: A mix of desktop software (built on Microsoft Access) and web apps, it suffers from a poor user experience, and slow and glitchy performance, impacting work efficiency. Generating, downloading, and printing reports are cumbersome.

- Council-Specific Functionality: Lacks robustness, and can only run a balance sheet when all banks are reconciled to the same date. Slow performance is particularly noticeable when printing reports.

- Overall Assessment: AdvantEDGE’s combination of desktop and web components doesn’t translate to a smooth user experience. Its slow performance, particularly in report generation, and lack of robustness make it a less favourable choice for council operations.

- Star Rating: ⭐⭐⭐☆☆ (3 out of 5)

Conclusion: Finding the Right Fit

Each software provider has its strengths and limitations. The best choice depends on your council’s specific needs, balancing usability with council-specific functionality. As you consider these options, reflect on how each aligns with your council’s operational practices and the expertise of your team members. The right software should not only streamline financial processes but also support your council’s unique regulatory and operational requirements.